Marketing has shifted from simply promoting products or services to creating, communicating, and delivering value to customers. This evolution gave rise to different types of marketing, each designed to build lasting relationships and drive business growth.

“People do not buy goods and services. They buy relations, stories, and magic.” — Seth Godin

TL;DR

- SEO (Search Engine Optimization): Boosts organic visibility in search engines and strengthens brand trust.

- Content Marketing: Uses blog posts, videos, and infographics to educate, build credibility, and spark engagement.

- PPC (Pay-Per-Click) Advertising: Runs paid campaigns on Google and social platforms for quick leads and conversions.

- Social Media Marketing: Connects through Facebook, Instagram, and LinkedIn to grow brand awareness, engagement, and web traffic.

- Email Marketing: Delivers segmented, personalized campaigns that nurture relationships and increase customer value.

What Is Marketing?

Marketing connects products with people by making brands visible and relatable. Without awareness, even the best products stay unnoticed. Marketing works like storytelling, shaping narratives that spark interest and build trust with potential customers. Over time, technologies and creative methods expanded how stories reach audiences.

The practice of marketing dates back to ancient trade, but grew rapidly after the Industrial Revolution. Today, businesses use many types of marketing: from traditional marketing like print and radio to digital marketing through search engines and social media, to engage, retain, and grow their customer base.

Types of Marketing

Businesses choose different types of marketing based on goals, target audience, and budget. These marketing types fall into two broad groups: traditional marketing and digital marketing.

Here, we cover 14 types of marketing that companies use to build stronger brands and attract customers. While many marketing professionals rely on seven core categories—Traditional Marketing, Digital Marketing, Content Marketing, Inbound Marketing, Outbound Marketing, Brand Marketing, and Social Media Marketing—we also look at specialized forms like influencer marketing, referral marketing, and guerrilla marketing.

1. Traditional Marketing

Traditional marketing remains one of the oldest types of marketing, promoting brands through newspapers, television, radio, direct mail, telemarketing, billboards, and posters. These methods help businesses reach local and national audiences through familiar channels.

These traditional channels still matter for brands that want visibility alongside newer digital marketing types.

Types of Traditional Marketing Strategies:

1.1. Print Marketing Strategy

Print marketing uses newspapers, magazines, pamphlets, and flyers to attract attention at local or national levels.

Companies promote services in communities cost-effectively through these printed materials.

1.2. Broadcast Marketing Strategy

Broadcast marketing delivers content through television, radio, and cinema screens, using audio and visuals to engage audiences.

Commercials target groups with shared interests through these electronic channels.

1.3. Outdoor Marketing Strategy

Outdoor marketing places ads in public spaces like billboards, transit posters, and vehicle wraps.

These ads rely on visibility in high-traffic areas to capture attention.

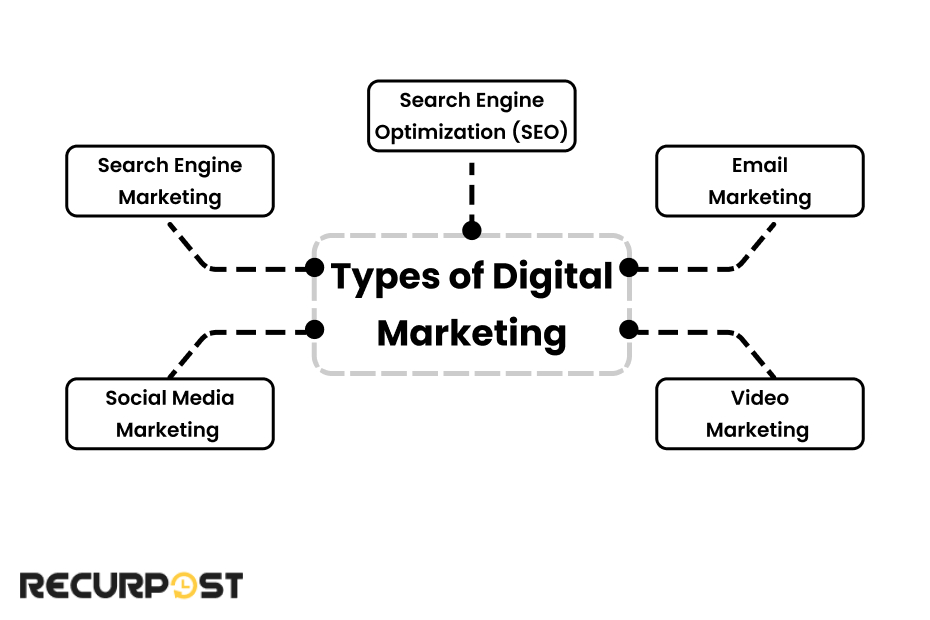

2. Digital Marketing

Digital marketing is one of the most widely used types of marketing, promoting brands through digital channels and technology. The American Marketing Association (AMA) defines it as reaching customers where they spend time online.

Digital marketing connects with people through social media platforms, search engines, email, and websites. This form of marketing includes several categories that businesses rely on today.

Types of Digital Marketing Strategies:

2.1. Social Media Marketing

Social media marketing builds an online presence on platforms where brands connect directly with consumers while promoting services.

Social channels let businesses amplify their voice, grow audiences, and create brand communities in a cost-friendly way.

Many companies outsource social media tasks to professionals, saving time while maintaining strong results.

This type of valuable marketing includes Facebook, Instagram, Twitter, Pinterest, LinkedIn, YouTube, and even paid options like social ads and Google Ads.

2.2. Search Engine Marketing

Search Engine Marketing uses search engines to display business pages and social content, aiming to appear on Search Engine Results Pages (SERPs).

This form of marketing is divided into Search Engine Optimization (SEO) and Pay-Per-Click (PPC) Advertising, combining organic and paid tactics.

2.3. Search Engine Optimization (SEO)

Search Engine Optimization (SEO) improves website visibility in search results, drawing organic, non-paid traffic.

Search Engine Optimization uses keywords, traffic patterns, and campaigns to help businesses reach people through search engines.

2.4. Email Marketing

Email marketing delivers messages directly to inboxes in a personalized, cost-friendly way.

Businesses segment their lists to tailor messages, promote products, share news, and nurture communities through inbound methods.

Email tools also track results, offering insights into customer preferences.

2.5. Video Marketing

Video marketing uses videos as part of campaigns, helping brands showcase products and tell stories visually.

Many marketers include video marketing in their mix for stronger results, often relying on social media video tools to reach more viewers.

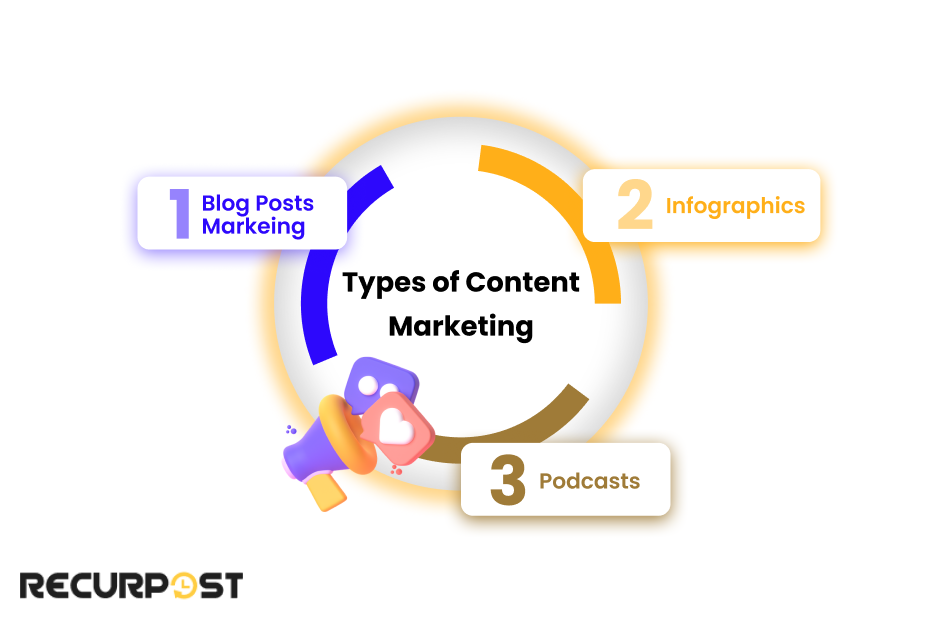

3. Content Marketing

Content marketing is one of the most widely used types of marketing, creating blog posts, white papers, case studies, e-books, infographics, and webinars. These formats help brands share useful knowledge, strengthen relationships, and inspire customer action.

Companies use this form of marketing to introduce products, share updates, gather customer information, and keep people engaged beyond the initial content.

Digital Marketing Campaign Template

Types of Content Marketing Strategies:

3.1. Blog Posts Marketing

Blog posts marketing uses written articles to inform readers while supporting SEO. Consistent blogs grow authority, bring organic website traffic, and meet audience needs with tailored topics.

Many businesses, from social media management firms to construction companies, use blogs for research and outreach. RecurPost is one example.

3.2. Infographics

Infographics turn data and statistics into visuals using text, charts, and diagrams to share messages quickly.

- E-books are digital publications, usually 10–50 pages, that give readers detailed knowledge on a topic. Many B2B companies use them to explain products or share insights.

- White papers are formal documents with research-driven content that help companies present findings and support decision-making.

3.3. Podcasts

Podcasts are a growing part of content marketing, giving small businesses a direct channel to their target audience. By sharing conversations and stories, podcasts build personal connections with listeners, which helps in marketing.

When produced consistently, they can support a brand’s content mix, increase website visits, generate leads, and boost conversions. Have a look at this:

4. Inbound Marketing

Inbound marketing is one of the types of marketing that brings customers in rather than interrupting them. It focuses on consumer needs, directing resources toward attraction instead of disruption.

Its foundation rests on attracting, engaging, and keeping the audience satisfied. The inbound marketing funnel includes blog marketing, viral marketing, and other methods.

4.1. Blog Marketing

Blog marketing promotes businesses, products, or services through blog content to build customer bases and increase website traffic.

The target audience for this type of marketing often includes marketing professionals, management firms, and similar groups.

4.2. Viral Marketing

Viral marketing spreads messages quickly, aiming for rapid growth both online and offline.

Content is often emotional, entertaining, or visually engaging. Formats include videos, memes, and social media posts on platforms like Facebook and Instagram.

5. Outbound Marketing

Outbound marketing is a type of marketing that reaches out to prospective customers instead of waiting for them to come naturally. Its goal is to build awareness and encourage conversions.

Common outbound methods include direct mail marketing and cold email marketing, both aimed at creating initial contact with new audiences.

5.1. Direct Mail Marketing

Direct mail marketing uses postcards, catalogs, letters, and brochures sent to a target audience based on demographics or purchase history. Personalized content often improves response rates, though delivery can take several days or weeks to reach potential customers.

5.2. Cold Email Marketing

Cold email marketing involves sending unsolicited emails to potential customers to promote a product or service. Businesses define their target audience by factors like company size or job title before sending personalized content. Digital agencies and other companies often use this method to build awareness among new prospects.

6. Guerrilla Marketing

Guerrilla marketing is one of the types of marketing that uses unconventional, low-cost tactics to promote products and capture attention. Creative content helps brands stand out in crowded markets.

These methods aim to spark public interest, generate buzz, and encourage word-of-mouth marketing. The term was introduced by Jay Conrad Levinson in his 1983 book Guerrilla Marketing.

Below are common forms of guerrilla marketing.

6.1. Flash Mobs

Flash mobs are a type of guerrilla marketing where groups gather in public spaces to perform a planned action for entertainment or promotion. These short events are often coordinated through social media marketing on platforms like Instagram and Facebook.

6.2. Stealth Marketing

Stealth marketing takes a covert approach, promoting products or brands in ways not immediately seen as advertising. The goal is to engage customers subtly, often relying on word-of-mouth marketing to create buzz among potential buyers.

7. Brand Marketing

Brand marketing is a Type of Marketing that builds and promotes brands, fostering loyalty and trust among target audiences. It strengthens brand equity, raises awareness, and establishes recognition through digital brand marketing, co-branding, and personal brand marketing.

7.1. Digital Brand Marketing

This involves the use of digital marketing channels such as social media, websites, and search engines to build a brand’s online presence. It includes digital advertising, influencer marketing, and content marketing.

7.2. Personal Brand Marketing

This strategy is used by individuals (influencers, celebrities) to create a unique personal identity that resonates with their audience. It often uses the person’s expertise, values, and personality to build a loyal following.

7.3. Co-Branding

This strategy involves collaborations between two or more brands to create a combined product or experience that is beneficial to both. The aim is to reach new potential customers.

8. Event Marketing

Event marketing is a type of marketing where brands create or sponsor events to engage their target audience. Companies use this method to build awareness, generate leads, and strengthen relationships through conferences, webinars, and trade shows.

8.1. Seminars

Seminars are smaller, focused events aimed at teaching participants a topic or skill. This form of event marketing is widely used for education and engagement.

8.2. Webinars

Webinars are online versions of seminars, allowing participation from anywhere. Both seminars and webinars are common types of event marketing used to reach niche audiences.

8.3. Trade Shows

Trade shows give businesses the chance to showcase products or services to other professionals. This form of event marketing is popular for networking, generating leads, and growing business opportunities.

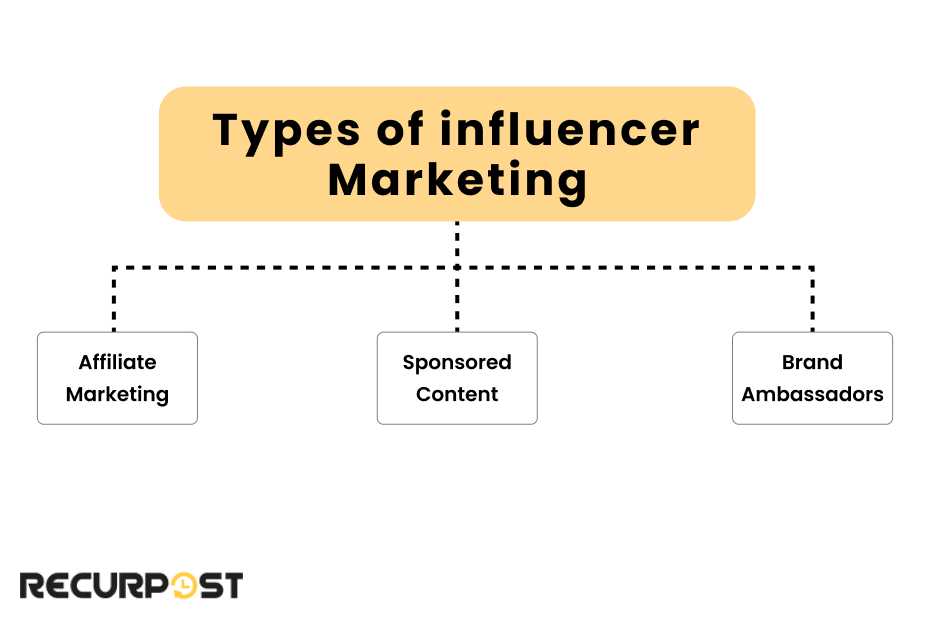

9. Influencer Marketing

Influencer marketing is a type of marketing where niche experts promote company products to their audiences. It often includes affiliate marketing, sponsored content, and brand ambassador programs.

9.1. Affiliate Marketing

Affiliate marketing is performance-based, where influencers earn commissions for generating traffic or sales. Both affiliates and businesses benefit, making it a common choice for social media marketing.

9.2. Sponsored Content

Sponsored content is a type of influencer marketing where brands pay influencers to promote products through posts, stories, reels, or videos. This is a form of paid advertising aimed at reaching the brand’s target audience.

9.3. Brand Ambassadors

Brand ambassador programs create long-term partnerships between influencers and brands. These collaborations promote products over extended periods and remain a trusted form of influencer marketing today.

10. Referral Marketing

Referral marketing belongs to the types of marketing that motivate existing customers to recommend products or services. Businesses gain new customers by relying on trust among family, friends, and colleagues, supported by word-of-mouth marketing and loyalty programs.

10.1. Word of Mouth Marketing

Word-of-mouth marketing depends on customer experiences, opinions, and recommendations to attract new buyers. Trust plays a major role in influencing purchase decisions. Common forms include buzz marketing and organic marketing, both driven by authentic customer voices.

10.2. Customer Referral Programs

Customer referral programs reward existing customers for bringing in new ones. Recognition may include cash bonuses, discounts, or loyalty points, keeping referrals active and rewarding over time.

11. B2B Marketing

B2B marketing is one of the types of marketing that sells products or services to other businesses rather than consumers. Marketing professionals often target small businesses and corporations using lead-based marketing and account-based marketing.

12. B2C Marketing

B2C marketing is one of the types of marketing that sells products or services directly to consumers. Marketing teams study consumer needs, preferences, and behaviors to create targeted content.

They collect data through social media channels using polls, Q&A sessions, surveys, and questionnaires.

13. Conversational Marketing

Conversational marketing belongs to the types of marketing that build customer relationships through real-time interactions. It creates personalized experiences using chatbots and WhatsApp messaging.

13.1. Chatbots

Chatbots are AI-based systems that interact with customers in real time, making them a significant marketing tactic. They answer basic questions, gather information, and guide people during their journey, helping companies in after-sales marketing.

13.2. WhatsApp Messaging for marketing

WhatsApp messaging is a social media tool that businesses use to promote products or chat directly with customers. It allows bulk outreach through Broadcast Lists and supports two-way conversations, making it one of the most common social platforms for interaction.

14. Behavioral Marketing

Behavioral marketing is one of the types of marketing that targets people based on their actions instead of demographics. Companies gather user engagement data from websites, apps, emails, and ads to deliver personalized content matching interests.

- Amazon uses behavioral data to suggest products based on past purchases.

- Netflix recommends shows and movies based on viewing patterns and ratings, making it a marketing tactic based on collective behavior.

- Spotify creates playlists like “Discover Weekly” based on user listening habits, boosting satisfaction and retention, hence an important type of marketing.

Modern Marketing Types: The Evolution of Marketing Strategies

Marketing has evolved, with modern types of marketing emphasizing digital engagement, personalization, and data-driven methods. From the 14 categories discussed, several stand out as modern forms:

- Digital Marketing: A core part of modern marketing, covering social media, search engines, and mobile platforms.

- Content Marketing: Modern content marketing extends beyond blogs to include interactive media, AR/VR experiences, and multimedia storytelling.

- Influencer Marketing: Builds social proof through partnerships with influencers and creators who hold credibility with their audiences.

- Conversational Marketing: Uses AI-powered chatbots and messaging apps to create personalized, real-time interactions with customers.

- Behavioral Marketing: Applies data analytics to deliver personalized experiences shaped by customer actions and preferences.

These modern types of marketing share traits: data-driven, customer-focused, and built around relationships rather than products. Modern marketing is also measurable, letting marketers track results and refine campaigns in real time.

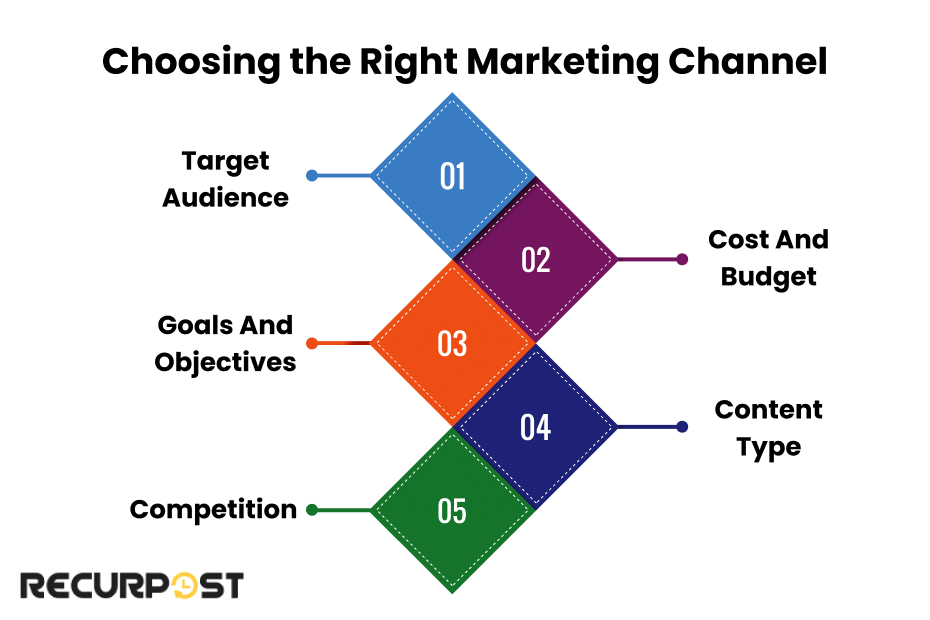

Choosing The Right Marketing Channel

Selecting the right channel is part of choosing the best types of marketing for your business. Consider:

1. Target Audience

Begin by defining your audience and where they spend time. Young adults may prefer Instagram or TikTok, while professionals often use LinkedIn. Knowing this helps match the channel to your audience.

2. Cost and Budget of Marketing

Some channels require higher budgets, such as Facebook Ads or Google Ads. Others, like organic content on Instagram or LinkedIn, are less costly but require time and consistent content creation. Balance your goals with the budget available for marketing.

3. Goals and Objectives for Marketing

Different channels serve different goals. For brand awareness, visual platforms like Instagram or YouTube work well. For lead generation or sales, Google Ads or email marketing are stronger choices.

4. Content Type

Match channels to the type of content you create. Articles and blogs fit LinkedIn or Medium. Videos perform better on YouTube or TikTok. Always align content type with audience preference.

5. Competition

Review where competitors are active. If they succeed on a platform, consider it, but if the space feels crowded, look for less saturated channels where your content has room to grow.

By weighing these factors, you can choose the marketing channel that best fits your goals and delivers a stronger return on investment (ROI).

Conclusion

Different types of marketing help businesses grow in competitive markets. Each type, from traditional print to modern digital methods, connects with target audiences in distinct ways. While 14 types exist, many marketers rely on 7 main categories: Traditional, Digital, Content, Inbound, Outbound, Brand, and Social Media Marketing as the foundation. Depending on business needs, companies may use 3–5 core types or add 10–12 specialized forms.

Marketing keeps evolving, so businesses must adapt to trends and techniques. Choose the types of marketing that align with your audience and refine them to maintain lasting impact.

FAQs on Types of Marketing

1. What are the 4 Ps in Marketing?

Product, price, place, and promotion make up the Four Ps, also known as the marketing mix. Neil Borden introduced the mix in the 1950s, shaping modern types of marketing.

2. What are the other types of marketing?

Beyond the 14 covered, businesses also use other types of marketing, both traditional and modern. Examples include global marketing, acquisition marketing, door-to-door marketing, and product marketing.

3. Difference between blog marketing and blog post marketing?

Blog marketing uses the entire blog as a tool for branding and engagement.

Blog post marketing, on the other hand, promotes specific articles to increase traffic and amplify reach for individual pieces.

4. Difference between email and direct mail marketing?

Email marketing is faster, lower cost, and allows personalized messages, though emails can be ignored or flagged as spam.

Direct mail marketing is slower and more costly, but includes physical letters and postcards that create a tangible impact.

5. Difference between email and cold email marketing?

Email marketing targets existing subscribers, maintaining ongoing relationships and sharing updates.

Cold email marketing reaches new audiences who haven’t subscribed, aiming to build connections and gain responses.

6. What are the 7 types of marketing strategies with examples?

The 7 main types of marketing strategies are:

Traditional Marketing: Billboard ads for Coca-Cola or TV commercials for insurance companies.

Digital Marketing: Google Ads for e-commerce or SaaS email newsletters.

Content Marketing: HubSpot’s blog posts or Red Bull’s extreme sports videos.

Inbound Marketing: Shopify’s free business tools or Canva’s design templates that attract users.

Outbound Marketing: Cold calls from B2B software companies or direct mail catalogs.

Brand Marketing: Nike’s emotional ad campaigns or Apple’s minimalist launches.

Social Media Marketing: Wendy’s Twitter presence or GoPro’s user-generated Instagram content.

Debbie Moran is a Digital marketing strategist with 5+ years of experience producing advertising for brands and helping leaders showcase their brand to the correct audience. She has been a part of RecurPost since 2019 and handles all the activities required to grow our brand’s online presence.